Great news! We have a FREE Digital Marketing Professional Program to share with you Princeton & Area!

ONLY 40 Spots… starts soon… Completely REMOTE… take a read!

EXCEL Career College is Offering AN Incredible Opportunity!!

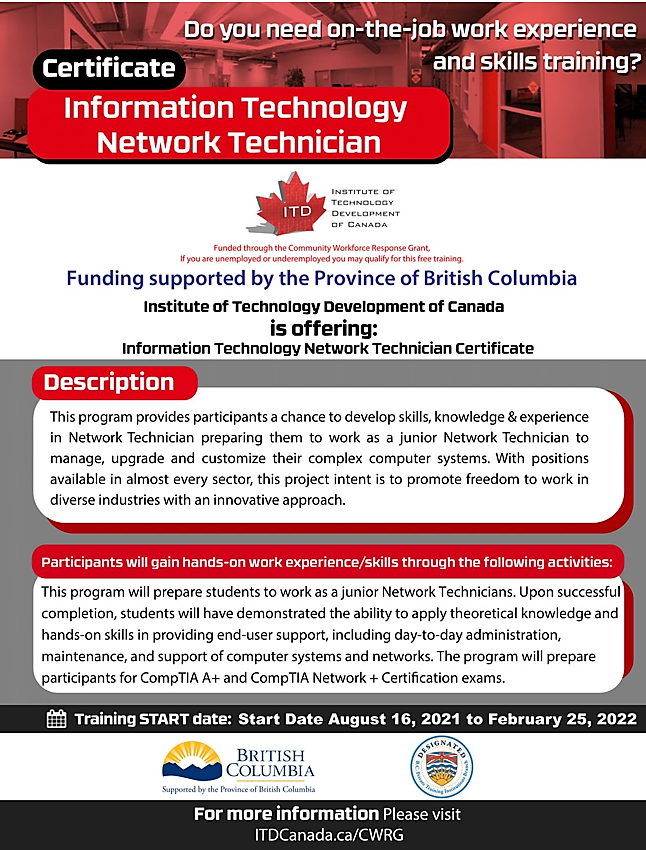

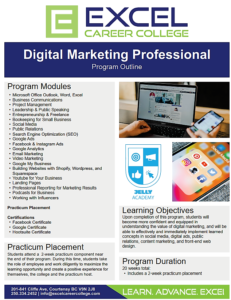

Please see the attached program outline and have people fill out the link below. The start date is October 25th 2021, with classes running for 20 weeks which includes a 2 week practicum. I currently do not have the hours but I will be sending out the schedule as soon as I have it.

Examples of some job and role descriptions for digital marketing

- Analytics Manager.

- CRM and Email marketing Manager.

- Digital Agency Account Manager and Sales Director.

- Digital Marketing Manager and Web Manager.

- Ecommerce Manager.

- PPC Search Manager.

- Search Manager / SEO Manager.

We only have space for 40 students. Since this is all taught online using our virtual platform Zoom, anyone can apply so please share this email with coworkers, friends and family! Any questions please let Teresa @ EXCEL CAREER COLLEGE know.

Below is the PDF Flyer on the Program:

Digital Marketing Professional Outline (2)

This is the link where applicants are to apply: https://forms.gle/Urjdsco8rB3ySb2j6

Teresa Matesanz/ Executive Client Relations

teresam@excelcareercollege.com

Excel Career College

250.334.2452/250.334.1014

Oct 16th

Oct 16th